Переходьте в офлайн за допомогою програми Player FM !

Episode 384: Leverage Your Life Insurance Policy with Sarry Ibrahim

Manage episode 460312548 series 1610796

In this episode, we ask:

- Have you faced threats?

- How might you bring greater benefit to you and your family?

- Have you heard Sarry Ibrahim’s podcast, Thinking Like a Bank, Episode 123?

- What did Sarry’s client ask?

- What is the story with A.L. Williams?

- Has that worked? Would it work now?

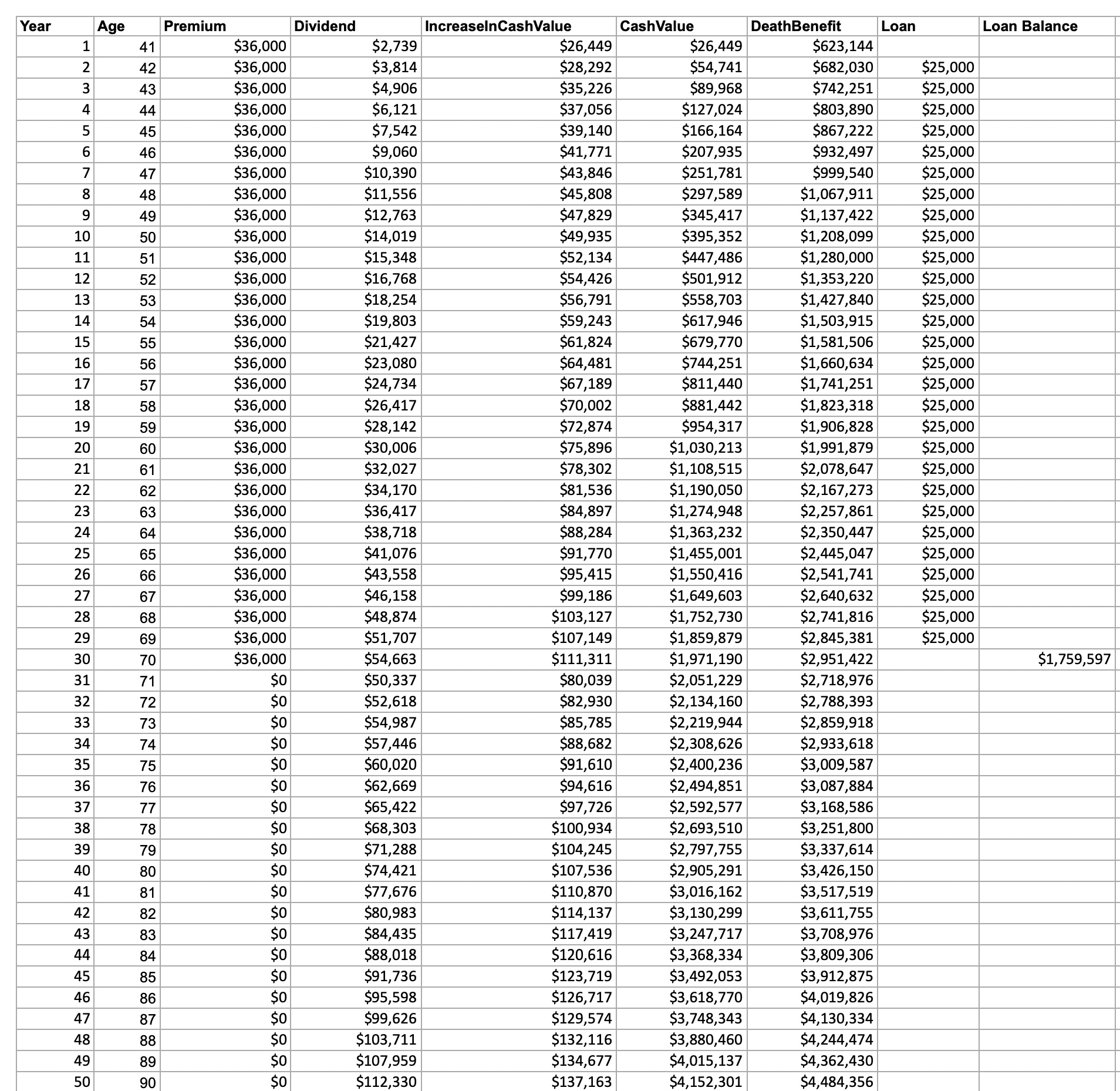

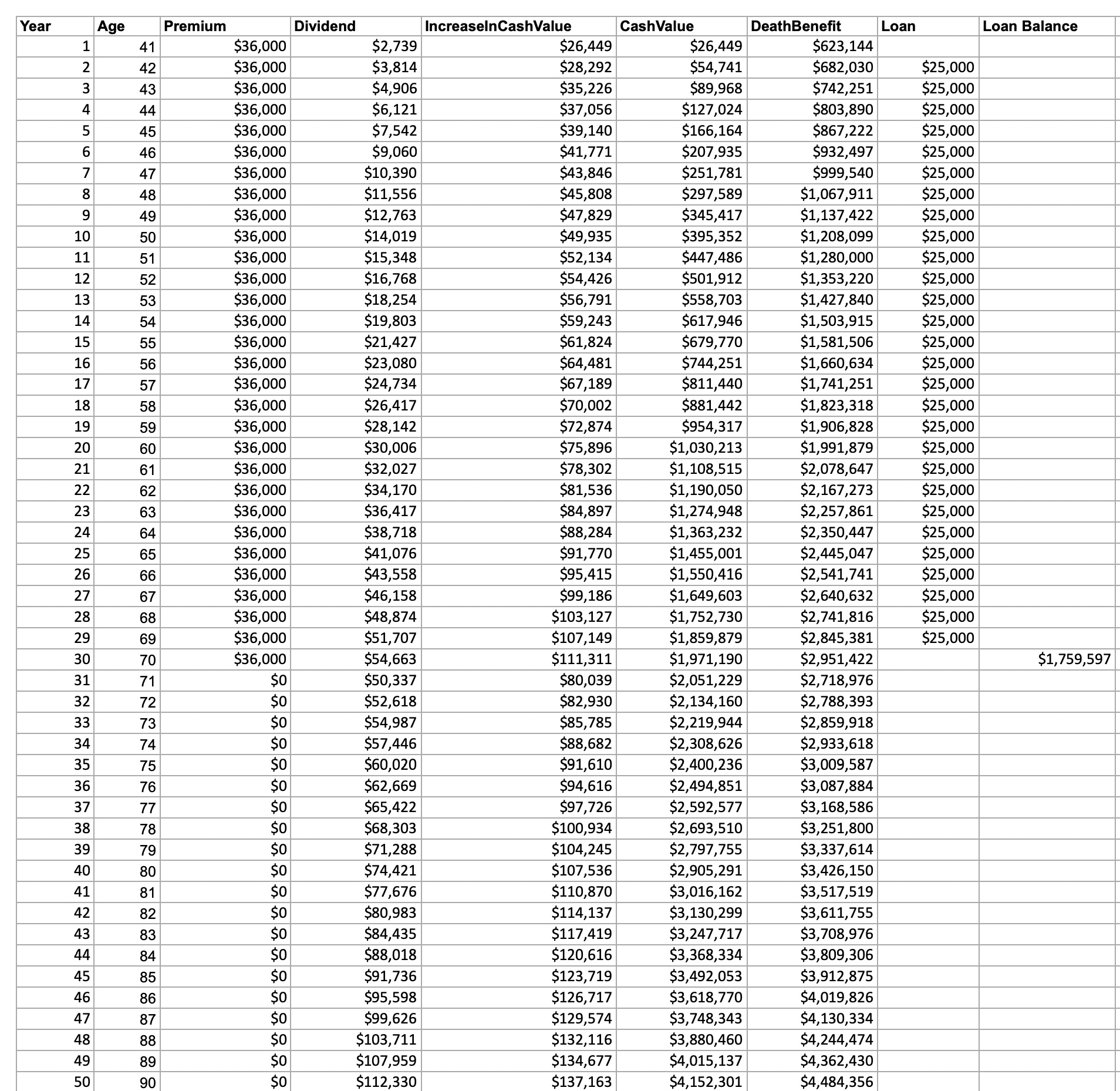

- What about the whole life policy spreadsheet?

- What are some options / hyptothetical scenarios?

- What if there was $36,000 dollars to allocate each year for 30 years? ($3K/month)

- What about investing $34,383 at a hypothetical 8% return, with a 1% compounding fee ever year for 30 years? What about purchasing a term policy with $1,616 for $600K death benefit for the 30 years?

- How about purchasing a whole life insurance policy only? What happens at year 30?

- What about purchasing a whole life insurance policy, taking a policy loan against the policy, investing the money and paying off the policy loan with the growth (hopefully) from the investment?

- What is possible, considering volatility?

- What are the better ways to do this?

- What if it is just a death benefit?

- What about investing the difference?

- Why would whole life insurance be a better fit?

- What are the takeaways?

The topics presented in this podcast are

general information only

and not for the purposes of providing legal, accounting or investment advice. On such matters, please consult a professional

who knows your specific situation.

Sarry Ibrahim, CFP®, EA, MBA, is located in Chicagoland and works with clients across the United States. As the founder of Financial Asset Protection, Sarry helps clients safely accumulate wealth without sacrificing liquidity.

Sarry Ibrahim, CFP®, EA, MBA, is located in Chicagoland and works with clients across the United States. As the founder of Financial Asset Protection, Sarry helps clients safely accumulate wealth without sacrificing liquidity.

When Sarry is not working with clients, he hosts episodes on the Thinking Like a Bank Podcast, and he enjoys spending time with his wife and son.

Connect with Sarry (rhymes with Larry) at

https://thinkinglikeabank.com/

https://www.youtube.com/@sarryibrahim4241

https://www.linkedin.com/in/sarry-ibrahim-mba-ltcp-bank-on-you

337 епізодів

Manage episode 460312548 series 1610796

In this episode, we ask:

- Have you faced threats?

- How might you bring greater benefit to you and your family?

- Have you heard Sarry Ibrahim’s podcast, Thinking Like a Bank, Episode 123?

- What did Sarry’s client ask?

- What is the story with A.L. Williams?

- Has that worked? Would it work now?

- What about the whole life policy spreadsheet?

- What are some options / hyptothetical scenarios?

- What if there was $36,000 dollars to allocate each year for 30 years? ($3K/month)

- What about investing $34,383 at a hypothetical 8% return, with a 1% compounding fee ever year for 30 years? What about purchasing a term policy with $1,616 for $600K death benefit for the 30 years?

- How about purchasing a whole life insurance policy only? What happens at year 30?

- What about purchasing a whole life insurance policy, taking a policy loan against the policy, investing the money and paying off the policy loan with the growth (hopefully) from the investment?

- What is possible, considering volatility?

- What are the better ways to do this?

- What if it is just a death benefit?

- What about investing the difference?

- Why would whole life insurance be a better fit?

- What are the takeaways?

The topics presented in this podcast are

general information only

and not for the purposes of providing legal, accounting or investment advice. On such matters, please consult a professional

who knows your specific situation.

Sarry Ibrahim, CFP®, EA, MBA, is located in Chicagoland and works with clients across the United States. As the founder of Financial Asset Protection, Sarry helps clients safely accumulate wealth without sacrificing liquidity.

Sarry Ibrahim, CFP®, EA, MBA, is located in Chicagoland and works with clients across the United States. As the founder of Financial Asset Protection, Sarry helps clients safely accumulate wealth without sacrificing liquidity.

When Sarry is not working with clients, he hosts episodes on the Thinking Like a Bank Podcast, and he enjoys spending time with his wife and son.

Connect with Sarry (rhymes with Larry) at

https://thinkinglikeabank.com/

https://www.youtube.com/@sarryibrahim4241

https://www.linkedin.com/in/sarry-ibrahim-mba-ltcp-bank-on-you

337 епізодів

Усі епізоди

×Ласкаво просимо до Player FM!

Player FM сканує Інтернет для отримання високоякісних подкастів, щоб ви могли насолоджуватися ними зараз. Це найкращий додаток для подкастів, який працює на Android, iPhone і веб-сторінці. Реєстрація для синхронізації підписок між пристроями.