Переходьте в офлайн за допомогою програми Player FM !

Money Talk Podcast, Friday June 28, 2024

Manage episode 426178761 series 1036924

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (June 24-28 2024)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

The pace of increases in housing prices slowed a little in April while still setting a record high, according to the S&P CoreLogic Case-Shiller home price index. Prices in April rose 6.3% from April 2023, down from a 6.5% year-to-year increase in March. Seasonally adjusted, the index rose 0.5% from March, the same monthly gain as from February. Among 20 cities closely followed by the home price index, 13 set all-time highs in April. Housing prices have remained a sticking point for Federal Reserve efforts to slow down overall inflation.

The Conference Board said its consumer confidence index sank slightly in June as expectations remained low but overall stayed within a narrow range that has prevailed for much of the last two years. Optimism from labor conditions continued to outweigh concerns about inflation and other matters, the business research group reported. Survey results showed plans for home buying stayed near record lows. Vacation plans kept rising but remained below pre-pandemic levels.

Wednesday

The annual rate of new home sales sank 11% in May and was down 16% from the previous year. Since April 2022, just after the Fed started raising interest rates, only one month has had sales above the pre-pandemic level. The Commerce Department reported that the inventory of new houses for sale was 9.3 months’ worth, up from 5.6 just before the pandemic and above the 6.1-month average since 1963. The median sales price of a new house declined 0.9% from May 2023 to $417,400.

Thursday

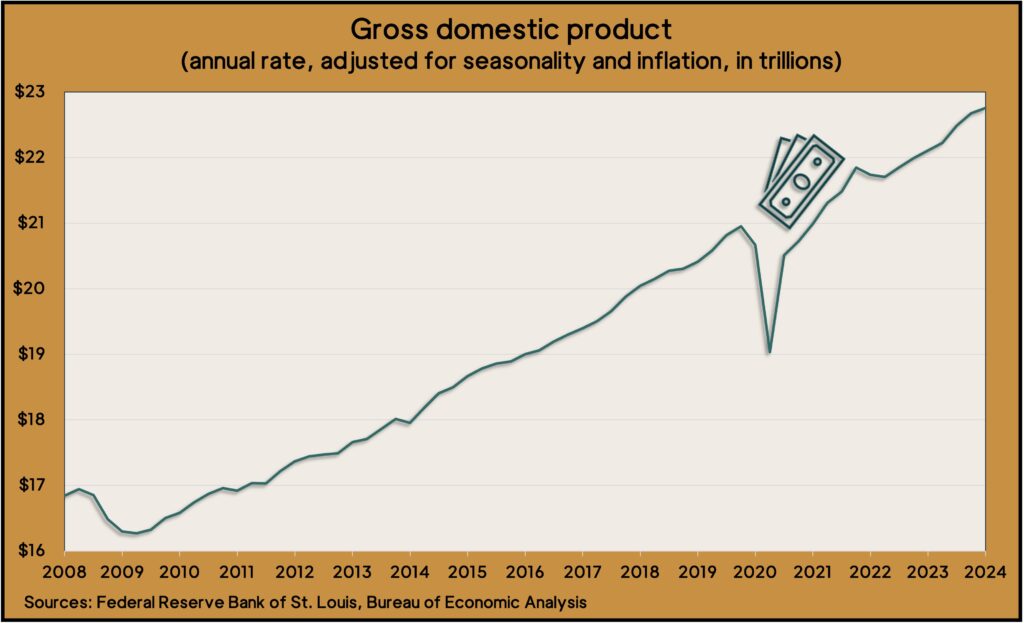

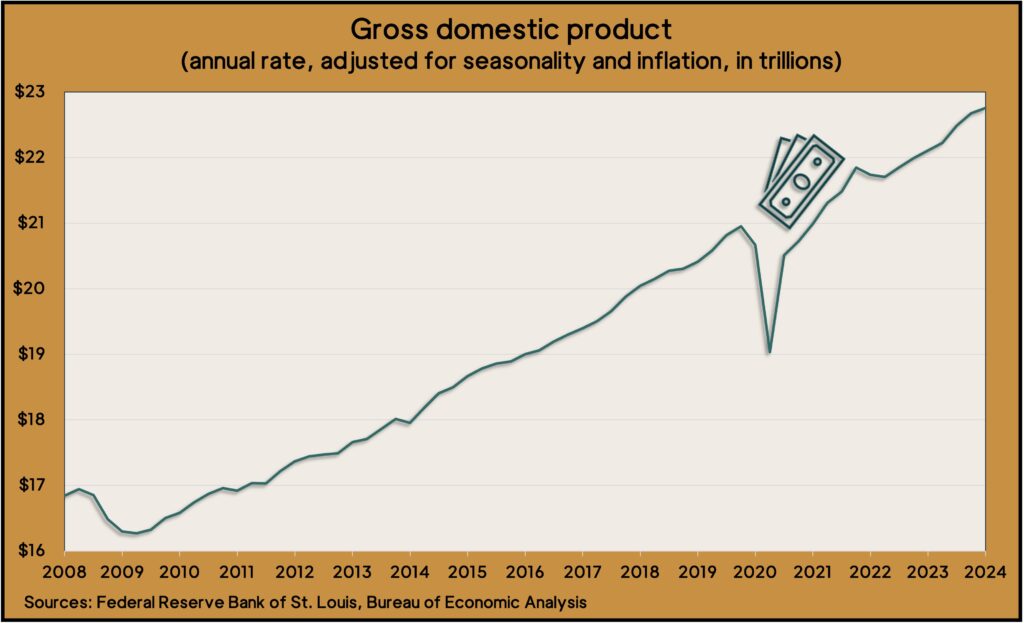

The U.S. economy grew at an annual pace of 1.4% in the first quarter, according to the last of three estimates of the gross domestic product. The rate was up from an earlier Bureau of Economic Analysis estimate of 1.3%, in part because imports – which weigh against economic growth – were lower. Consumer spending was weaker than initially reported, rising at a 1.5% annual rate instead of 2%. The overall 1.4% growth rate was down from a 3.4% pace in the final quarter of 2023 and was the slowest pace since back-to-back declines at the beginning of 2022.

The four-week moving average for initial unemployment claims rose for the sixth time in seven weeks, reaching its highest level since last August. Labor Department figures show the moving average 35% below the 57-year average and 13% higher than it was just before the COVID-19 pandemic. Close to 1.8 million Americans were claiming unemployment compensation in the latest week, up 1% from the week before and up 3% from the year before.

Orders for durable goods rose 0.1% in May, tapering off from gains of 0.2% in April and 0.8% in March. The Commerce Department measure of manufacturing demand was up 0.1% from May 2023. Excluding volatile orders for transportation equipment, demand fell 0.1% from April and was up 1.9% from the year before. Core capital goods orders, which indicate commercial investments, fell 0.6% for month, rose 0.9% from the year before.

Pending home sales sank 2.1% in May, according to an index from the National Association of Realtors. Demand for existing houses was nearly 7% below the index in May 2023. The trade group also noted increased housing inventory and said residential real estate prices should start stabilizing. The group forecast that traditional mortgage rates will level off at 6% for 2024 and 2025 and that sales should rise to 4.26 million houses this year, which would be about 4% higher than in 2023.

Friday

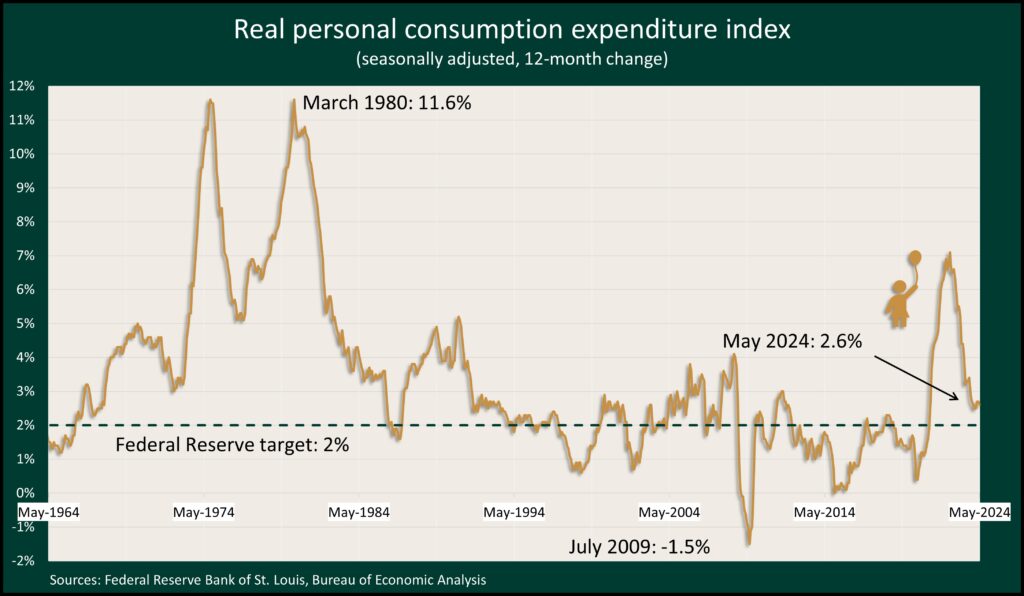

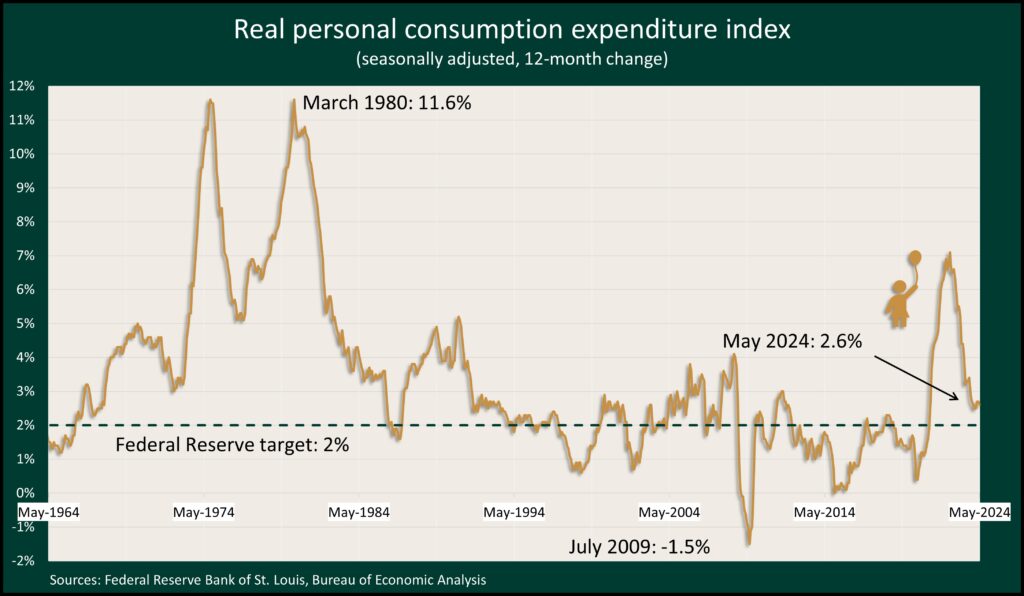

Inflation slowed in May amid subdued consumer spending, according to the Bureau of Economic Analysis. The Federal Reserve Board’s favorite measure of inflation eased to 2.6% from the year before, down from a four-decade high of 7.1% two years ago. It remained above the Fed’s long-range target of 2%. The personal consumption expenditures index was unchanged from April. A core measure that excludes volatile food and energy costs edged up 0.1% in May and was also 2.6% above May 2023, its smallest 12-month gain since March 2021. Personal spending, which accounts for about two-thirds of economic growth, increased by 0.2% in May while personal income rose 0.5%.

A precursor to consumer spending, consumer sentiment, was statistically unchanged in June with slightly weaker feelings toward current conditions and brighter outlooks for the year ahead and longer. The University of Michigan said its longstanding survey found attitudes still historically low, though 36% above their record trough in June 2022. Consumers expressed concerns of high prices and weakening incomes, but they also raised expectations amid prospected of softer interest rates.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 17733, up 43 points or 0.2%

- Standard & Poor’s 500 – 5461, down 4 points or 0.1%

- Dow Jones Industrial – 39123, down 27 points or 0.1%

- 10-year U.S. Treasury Note – 4.34%, up 0.09%

119 епізодів

Manage episode 426178761 series 1036924

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (June 24-28 2024)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

The pace of increases in housing prices slowed a little in April while still setting a record high, according to the S&P CoreLogic Case-Shiller home price index. Prices in April rose 6.3% from April 2023, down from a 6.5% year-to-year increase in March. Seasonally adjusted, the index rose 0.5% from March, the same monthly gain as from February. Among 20 cities closely followed by the home price index, 13 set all-time highs in April. Housing prices have remained a sticking point for Federal Reserve efforts to slow down overall inflation.

The Conference Board said its consumer confidence index sank slightly in June as expectations remained low but overall stayed within a narrow range that has prevailed for much of the last two years. Optimism from labor conditions continued to outweigh concerns about inflation and other matters, the business research group reported. Survey results showed plans for home buying stayed near record lows. Vacation plans kept rising but remained below pre-pandemic levels.

Wednesday

The annual rate of new home sales sank 11% in May and was down 16% from the previous year. Since April 2022, just after the Fed started raising interest rates, only one month has had sales above the pre-pandemic level. The Commerce Department reported that the inventory of new houses for sale was 9.3 months’ worth, up from 5.6 just before the pandemic and above the 6.1-month average since 1963. The median sales price of a new house declined 0.9% from May 2023 to $417,400.

Thursday

The U.S. economy grew at an annual pace of 1.4% in the first quarter, according to the last of three estimates of the gross domestic product. The rate was up from an earlier Bureau of Economic Analysis estimate of 1.3%, in part because imports – which weigh against economic growth – were lower. Consumer spending was weaker than initially reported, rising at a 1.5% annual rate instead of 2%. The overall 1.4% growth rate was down from a 3.4% pace in the final quarter of 2023 and was the slowest pace since back-to-back declines at the beginning of 2022.

The four-week moving average for initial unemployment claims rose for the sixth time in seven weeks, reaching its highest level since last August. Labor Department figures show the moving average 35% below the 57-year average and 13% higher than it was just before the COVID-19 pandemic. Close to 1.8 million Americans were claiming unemployment compensation in the latest week, up 1% from the week before and up 3% from the year before.

Orders for durable goods rose 0.1% in May, tapering off from gains of 0.2% in April and 0.8% in March. The Commerce Department measure of manufacturing demand was up 0.1% from May 2023. Excluding volatile orders for transportation equipment, demand fell 0.1% from April and was up 1.9% from the year before. Core capital goods orders, which indicate commercial investments, fell 0.6% for month, rose 0.9% from the year before.

Pending home sales sank 2.1% in May, according to an index from the National Association of Realtors. Demand for existing houses was nearly 7% below the index in May 2023. The trade group also noted increased housing inventory and said residential real estate prices should start stabilizing. The group forecast that traditional mortgage rates will level off at 6% for 2024 and 2025 and that sales should rise to 4.26 million houses this year, which would be about 4% higher than in 2023.

Friday

Inflation slowed in May amid subdued consumer spending, according to the Bureau of Economic Analysis. The Federal Reserve Board’s favorite measure of inflation eased to 2.6% from the year before, down from a four-decade high of 7.1% two years ago. It remained above the Fed’s long-range target of 2%. The personal consumption expenditures index was unchanged from April. A core measure that excludes volatile food and energy costs edged up 0.1% in May and was also 2.6% above May 2023, its smallest 12-month gain since March 2021. Personal spending, which accounts for about two-thirds of economic growth, increased by 0.2% in May while personal income rose 0.5%.

A precursor to consumer spending, consumer sentiment, was statistically unchanged in June with slightly weaker feelings toward current conditions and brighter outlooks for the year ahead and longer. The University of Michigan said its longstanding survey found attitudes still historically low, though 36% above their record trough in June 2022. Consumers expressed concerns of high prices and weakening incomes, but they also raised expectations amid prospected of softer interest rates.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 17733, up 43 points or 0.2%

- Standard & Poor’s 500 – 5461, down 4 points or 0.1%

- Dow Jones Industrial – 39123, down 27 points or 0.1%

- 10-year U.S. Treasury Note – 4.34%, up 0.09%

119 епізодів

Усі епізоди

×Ласкаво просимо до Player FM!

Player FM сканує Інтернет для отримання високоякісних подкастів, щоб ви могли насолоджуватися ними зараз. Це найкращий додаток для подкастів, який працює на Android, iPhone і веб-сторінці. Реєстрація для синхронізації підписок між пристроями.